| MQL5 Reference / Standard Library / Strategy Modules / Modules of Trade Signals |

|

|

Modules of Trade Signals

The standard delivery of the client terminal includes a set of ready-made modules of trade signals for "MQL5 Wizard". When creating an Expert Advisor in MQL5 Wizard, you can use any combination of the modules of trade signals (up to 64). The final decision on a trade operation is made on the basis of complex analysis of signals obtained from all included modules. The detailed description of the mechanism of making trade decisions is given below.

The standard delivery includes the following modules of signals:

The Mechanism of Making Trade Decisions on the Basis of Signal Modules

The mechanism of making trade decisions can be represented as the following list of basic principles:

Each generated Expert Advisor has two adjustable settings — threshold levels of opening and closing a position (ThresholdOpen and ThresholdClose) that can be equal to a value in the range of 0 to 100. If the strength of final signal exceeds a threshold level, a trade operation that corresponds to the sign of the signal is performed.

Examples

Consider an Expert Advisor with the following threshold levels: ThresholdOpen=20 and ThresholdClose=90. Two modules of signals participate in making decisions on trade operations: the MA module with weight 0.4 and the Stochastic module with weight 0.8. Let's analyze two variants of obtained trade signals:

Variant 1

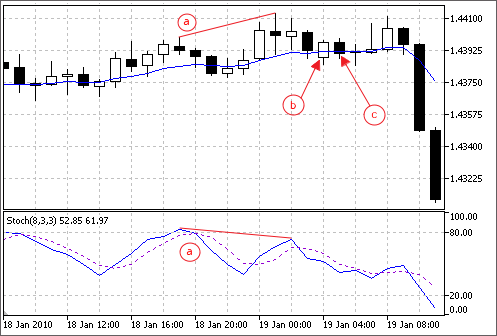

The price crossed the rising MA upwards. This case corresponds to one of the market models implemented in the MA module. This model implies a rise of price. Its significance is equal to 100. At the same time, the Stochastic oscillator turned down and formed a divergence with price. This case corresponds to one of the models implemented in the Stochastic module. This model implies a fall of price. The weight of this model is 80.

Let's calculate the result of final "voting". The rate obtained from the MA module is calculated as 0.4 * 100 = 40. The value from the Stochastic module is calculated as 0.8 * (-80) = -64. The final value is calculated as the Arithmetic mean of these two rates: (40 - 64)/2 = -12. The result of voting is the signal for selling with relative strength equal to 12. The threshold level that is equal to 20 is not reached. Thus a trade operation is not performed.

Variant 2

The price crossed the rising MA downwards. This case corresponds to one of the models implemented in the MA module.This model implies a rise of price. Its significance is equal to 10. At the same time, the Stochastic oscillator turned down and formed a divergence with price. This case corresponds to one of the models implemented in the Stochastic module. This model implies a fall of price. The weight of this model is 80.

Let's calculate the result of final "voting". The rate obtained from the MA module is calculated as 0.4 * 10 = 4. The value from the Stochastic module is calculated as 0.8 * (-80) = -64. The final value is calculated as the Arithmetic mean of these two rates: (4 - 64)/2 = -30. The result of voting is the signal for selling with relative strength equal to 30. The threshold level that is equal to 20 is reached. Thus the result is the signal for opening a short position.

a) Divergence of the price and the Stochastic oscillator (variants 1 and 2).

b) The price crossed the MA indicator upwards (variant 1).

c) The price crossed the MA indicator downwards (variant 2).